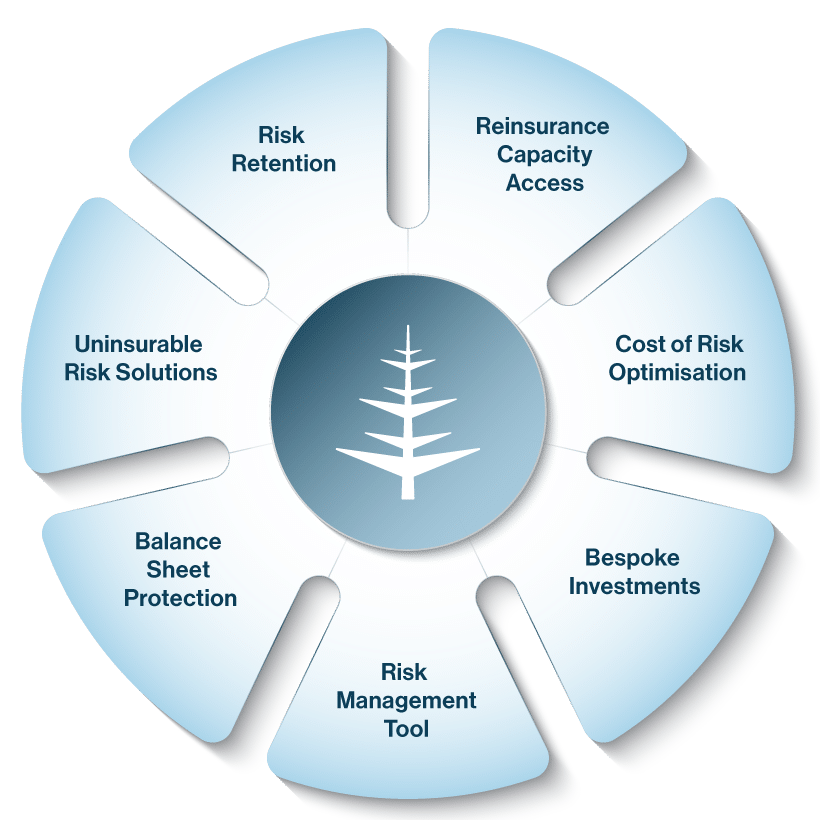

OUR OFFERING

About Bespoke Structures

Norfolk’s central organisational principle is to give its clients an equity participation in Norfolk’s shareholding structure. Clients participating in the structured programmes are issued preferred shares. Each block of shares is made up of a distinct class of non-voting preferred shares with dividend entitlement related to the insurance business of that particular client.

These preferred shares provide the capacity to write insurance business and ensure compliance with solvency requirements. In subsequent years the retained profits in each cell could supplement solvency requirements for writing higher premium volume or increased risk retention within the insurance programme. In the event that excess reserves exist, retained profits are returned to the shareholder in the form of dividends or return premiums.

Commercial certainties and protection are codified through a Private Act by the Bermuda Legislature entitled ‘Norfolk Reinsurance Company Limited Act 1999’.

Advantages over Conventional Insurance

- All underwriting profit and investment income earned by individual insurance programmes accrue to the specific preferred shareholder.

- Under Bermudan law, Norfolk is not subject to income taxation thus making the accumulation of tax-free or tax-sheltered funds possible. Any underwriting profit and investment income may accumulate on a tax-deferred basis until a dividend is declared in favour of the preferred shareholder. In this way Norfolk provides innovative opportunities for achieving balance sheet protection and responsible tax planning. Any tax advantage is obviously subject to the laws of the jurisdiction within which the preferred shareholder operates.

- By grouping a number of insurance programmes under one license, economies of scale are achieved that significantly lower the administration costs of such a facility.